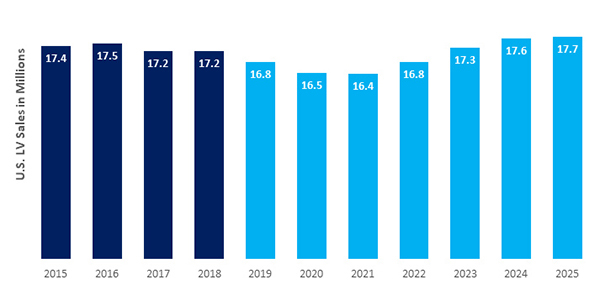

The Center for Automotive Research’s (CAR) updated automotive sales outlook forecasts U.S. light vehicle sales at 16.8 million units for 2019. CAR’s forecast includes a continuation of sales declines in 2020 and 2021 down to 16.5 million units in 2021. Sales are projected to rebound to 16.8 million units by 2022 and continue an upward trend through 2025.

According to CAR, there are a number of positive factors that support a high level of U.S. light vehicle sales, including:

- Projected moderate U.S. economic output growth in 2019;

- Historically low U.S. unemployment rates;

- Relatively low oil prices continue through 2020

- Underlying nominal wage growth continues;

- High levels of consumer confidence were reached in Q4 2018; and

- Solid new housing starts and home prices rebounding to pre-recession levels.

Just as there are positives affecting the forecast, there is a range of trends and risk factors that could drive U.S. light vehicle sales lower, CAR says. These include:

- Uncertain passage of the United States Mexico Canada (USMCA) trade agreement;

- Continued imposition of steel and aluminum import tariffs – especially on Canada and Mexico, two of the largest sources of imported metals for the auto industry;

- Lingering effects from the December-January partial government shutdown and the possibility of another government hiatus;

- The potential national security tariffs that could be levied on imports of autos and automotive parts under Section 232;

- Long-term treasury yields falling to near the federal funds rate and the potential for a treasury yield curve inversion that is a leading indicator of a U.S. recession;

- Slowed global economic growth including auto sales declines in China, economic impacts of Brexit on the UK and EU, and slowing economic output in Japan; and

- Potential impact of trade negotiations with China, Japan, EU, and UK.

To gain more insights into the U.S. light vehicle market and what these trends mean for production and the overall North American auto and auto parts industry, CAR will hold its next Industry Briefing, “What’s In Store for the Automotive Industry in 2019?” from 8 a.m. to noon on Feb. 20. For more information, click here.