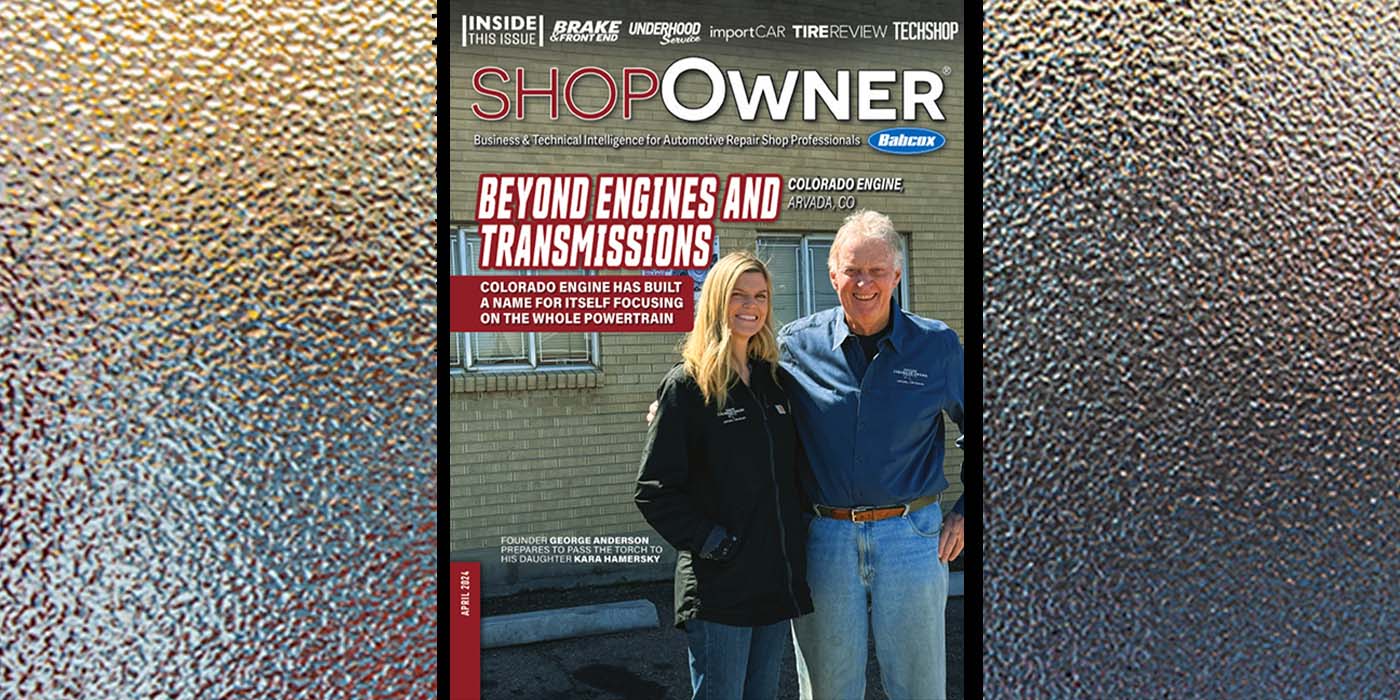

Many automotive repair and service shops are in danger of falling behind, becoming less profitable and losing customers because today’s business world is becoming increasingly technical in nature. So-called “digitalization,” the process of adopting digital technology, is rapidly impacting on the funding and financial services that are so important to repair shops and businesses.

Digitalization has become a buzzword, with businesses across all sectors realizing the benefits of digital technology for improving business operations, increasing productivity, and driving growth. There’s a growing trend among banks and other financial institutions to adopt new technologies transforming the traditional way of providing banking and financial services.

The variety of products, applications, processes and business models, that constitute today’s digitalization, especially the segment labeled as digital finance, are already having an impact on many within the automotive repair industry.

Digital Finance

Digital finance refers to the transformation of traditional banking and financial services that use the new technologies to provide the services that every repair shop can benefit from. Digital finance describes the continuing digital transformation of the financial marketplace, a transformation that does not just affect banks and financial institutions but, as mentioned, those whose businesses rely on them.

Digital finance is increasing the speed and agility of financial transactions and reducing transaction costs significantly. In the area of finance, digitalization involves the use of digital tools and technologies to specifically automate and streamline financial processes, improve data accuracy and consistency, and enhance financial analysis and reporting capabilities.

Digital banking is a key element of digital finance. Digital products and tools, including both online and mobile banking, help deliver financial services.

Using computers and mobile phones, shop owners can access their bank accounts, verify account details, transfer funds, deposit cash, pay bills and more. And, don’t forget those ATMs that have reduced the time taken to withdraw money from banks.

Among the examples of digital finance are:

- Mobile banking. Mobile or online banking helps both repair shops and their customers conduct banking transactions, transfer funds, pay bills and more using mobile phones and computers.

- FinTech solutions: FinTech companies provide a variety of digital services, from tracking spending, budgeting, to customer service “chatbots” and more, offered to end users such as repair and service shops.

- Digital wallets. A “digital wallet” is a type of financial transaction app that runs on any connected device. It securely stores the payment information and passwords of customers and the business itself.

- Blockchain technology. Another technology boosting digitalization in finance is blockchain. Blockchain is a type of shared database that differs from a typical database in the way it stores information. Different types of information can be stored on a blockchain and shared with other parties. Essential for much regulatory compliance, money laundering protection and, of course, peer-to-peer transactions.

- Robo-advisers. More of a personal aspect of digital finance, a robo-advisor is an online financial service that offers investment advice and automated portfolio management – usually at a low cost.

- Advances in digital finance technology, coupled with innovation, are being leveraged to identify opportunities to digitize a repair shop’s financial processes and supplement digital tools and technologies to improve its efficiency and accuracy.

Benefits Of Digital Finance

More efficiency. Digital tools were created to help repair and service businesses work more efficiently by removing manual time-consuming work from the operation’s normal business activities.

Increased security. The finance industry is subject to security and compliance requirements with good reason. They often process and handle sensitive and confidential information. It’s a similar story for most shops with the built-in finance automation tools adopted by banks and other financial institutions to support the security needs of the businesses that utilize those tools.

Improved customer experience. Customers nowadays expect a digital, smooth experience by default. Their interactions should be effortless and at their own convenience. With the market becoming more competitive, shops need to invest in digital tools to keep their customers satisfied and provide the expected level of service.

Insights & Analysis. Decentralized technologies enable the tracking and analysis of a shop’s financial data in real-time rather than waiting for reports from its professionals.

Today, almost every business has access to and the ability to handle large amounts of data. Unfortunately, without the tools to analyze that data, it is not of much help. Digital finance tools provide solutions based on that data and can be used to identify less expensive alternatives, business opportunities and growth possibilities.

On a similar note, although the terms “digital finance” and “digital banking” are sometimes used synonymously, there is a difference. While digital finance affects the entire financial industry and those who rely on it, digital banking is usually considered a subcategory. Digital banking usually refers to the processing of banking transactions.

Digital banking is not a new concept. However, recent events have significantly increased the use of online banking for digital transactions such as online payments and fund transfers. Digital banking includes all financial services that are carried out online or on mobile devices. These include e-banking, mobile banking apps or payment apps.

Digital finance does not merely affect bank customers in the context of digital banking – it includes all areas connected with finance and the transformation process brought about by digitalization. This has spurred the emergence of so-called “challenger banks.”

A challenger bank is a fully digital bank with no physical branches. They challenge traditional banks by making the customer experience smoother – from the ease of opening an account or applying for funding, to offering more attractive fees and rates.Digital finance refers to the delivery of traditional financial services digitally, using devices such as computers, tablets and smartphones. That includes financing the repair shop.

Most businesses typically use equity or debt financing – or a combination of the two. Equity financing involves receiving funds from an investor in exchange for partial ownership of the operation. Debt financing, on the other hand, involves borrowing money from a third party, which is then repaid, with interest. And, it is that debt financing segment of the digitalization transformation that is leading the way.

Alternative funding options may be a good fit in many situations. Strong, positive cash flow generally matters far more to challenger banks and other alternative lenders, easing the path to secured funds with less friction.

Online lenders have become popular – especially for businesses and their owners that are struggling with bad credit. With an online or alternative lender, bad credit is not always a barrier to getting the needed financing.

Alternative, online lenders are an option when the bank says no. Online lenders also offer fast cash with several online lenders able to process funding within 24 hours. Financial technology, or FinTech, interacts with a major bank minus the human element or is offered by independent companies working outside traditional banks.

Online lenders eliminate the middleman, such as banks, to connect borrowers with individuals and institutional investors. Somewhat unregulated, so-called funding “platforms” are an increasingly popular door-to-Internet financing.

Banks, credit unions and financial institutions use digital banking platforms to give their customers online channels for conducting traditional banking processes and activities. Most banking services can be digitized with the right solution provider.

Digital banks are a unique type of FinTech entity. They offer many of the same banking services of a traditional bank, but the main difference is that digital banks don’t have physical branches. In other words, digital banking platforms are financial services that are provided solely online, as opposed to online banking which refers to online components of traditional, brick-and-mortar banks.

Digital finance offers quite a few benefits to every repair shop. Thanks to digitalization, bank accounts can be opened within minutes and banking transactions accomplished around the clock, regardless of branch operating hours. What’s more, many banking services are being digitalized -– by some partners within the financial arena.

When using digital tools and technologies to improve financial analysis functionality, keep in mind they come with a number of security and privacy concerns that need to be addressed.

The requirement that third-party payment providers, such as PayPal and others, report all transactions has been temporarily postponed, but should be kept in mind. There is also concern over hacking and cyber-attacks, phishing scams, data breaches, tracking of transactions and customers, and unauthorized access to financial information.

Digital technology will continue shaping the future of finance. Digitalization is already having a major impact on the financial market and banks will continue to drive many changes in the future. For a repair or service shop, adopting digital finance tools will improve customer service, offer increased efficiency and, above all, reduce costs.