What Could Possibly Go Wrong And Other Things Murphy Knew

Business insurance – do you know what you really need?

Insurance Mysteries Solved: 6 Common Misconceptions

Understanding what insurance you have is Job 1. Knowing how to get what you need is just as important.

Business Insurance Options

Business insurance covers more than your personal security – does yours cover the important things?

Loaner And Courtesy Car Management For A Shop

A customer in a loaner vehicle is more likely to approve additional service work.

Are You Sure You’re Covered?

You may or may not be aware of potential automobile loss exposures at your business. If your shop owns any vehicles and uses them in the course of business, you most likely already have commercial auto insurance.

With Tougher Requirements, 57 Vehicles Clinch 2019 IIHS Safety Awards

Nearly five dozen 2019 models meet stricter criteria to qualify for a 2019 TOP SAFETY PICK+ or TOP SAFETY PICK award from the Insurance Institute for Highway Safety (IIHS).

Passing The Torch: Gen Xers, Millennials Becoming The Majority In The Classic Car World

For the first time ever, Gen Xers and millennials are seeking vehicle values via Hagerty’s Valuation Tools and classic vehicle insurance quotes more often than baby boomers and pre-boomers by a roughly 53-47 percent margin.

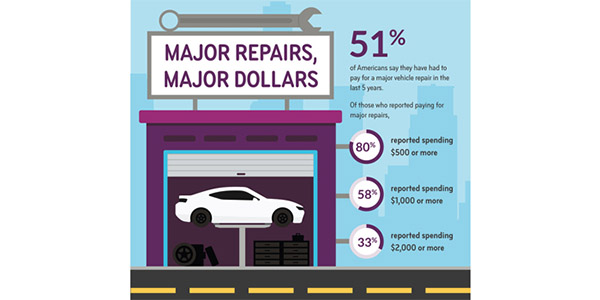

More Than Half Of Consumers Paid For Major Car Repairs In The Past 5 Years, According To Ally Financial

A 2018 Federal Reserve study also found that when faced with an unexpected $400 emergency expense, 41 percent of adults either could not pay the expense, or would need to borrow money or sell something to cover it.

How To Shop For Health Insurance

With the many different facets of health insurance, shopping for the right kind of coverage can be a daunting task for small business owners. With various policies, regulations and requirements, there is a lot to consider – not to mention the fact that health insurance is often the largest expense next to wages for a company.

Insurance Checkup: Getting The Best ‘Bang For Your Buck’

Insurance can be a large fixed cost for any shop. Periodic reviews of insurance needs and coverage, however, can help reign in your costs. Follow these tips during your next insurance checkup to make sure your business is covered and you’re getting the best bang for your buck.

Insurance Plans: Are You Covered?

You’ve worked hard to keep your business running. The last thing you need to worry about is an incident ending your business because you can’t afford to pick up the pieces. Reviewing your insurance plans about once a year is a good way to make sure you’re prepared to handle virtually any incident. To help you with a review, or as you shop for new coverage, we spoke with automotive insurance experts for advice on how you can make sure your business is covered.