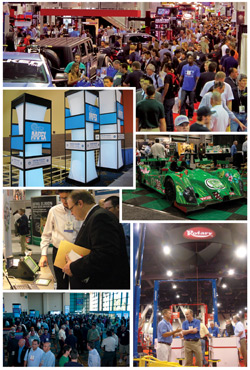

If you got a chance to attend the SEMA and AAPEX shows in November, you saw probably tens of millions of dollars’ worth of cars, products and equipment. It was an incredibly vast display of all things automotive. But how does all this stuff get out of the showroom and onto the floor of a typical repair shop?

If you got a chance to attend the SEMA and AAPEX shows in November, you saw probably tens of millions of dollars’ worth of cars, products and equipment. It was an incredibly vast display of all things automotive. But how does all this stuff get out of the showroom and onto the floor of a typical repair shop?

Manufacturers and distribution groups sell their wares to repair shop owners who need to upgrade equipment or add services. The owner typically pays cash, goes to his bank for a loan or, in some cases, leases the equipment or software. Basically, the buyer is motivated to make a capital improvement because it will make him more money, just as hiring a new technician would increase capacity and, therefore, revenue.

At the SEMA/AAPEX shows, a lot of manufacturers were showing off their racks, lifts, tire changers and balancers, and paint setups, but this time a handful of them were offering a monthly payment/lease option. One booth demonstrated how you could buy a tire balancer for eight and a half dollars a day. And the object of the demo? If you can make the equipment profitable from day one, then what’s holding you back from expanding your services?

According to the Department of Commerce, approximately 80% of all businesses in the U.S. lease equipment. Learning an alternative way to buy something with a ticket price greater than $1,000 can make sense for both the seller and the buyer. The seller moves more equipment and the buyer saves his/her cash for things like personnel, advertising or inventory. Paying a lump sum for equipment is like paying a technician’s annual salary on his first day. Equipment and technicians are there to make daily revenue, so you pay for them as they earn.

Paying monthly for a depreciating asset also makes accounting sense. Billionaire John Paul Getty famously stated that one should “Lease that which depreciates. Buy that which appreciates.” And many shop owners enjoy 100% tax deductibility of their purchase thanks to a beefed up Section 179 tax write-off (see accompanying sidebar). You can also finance the freight and installation. It’s pretty common to hear of equipment making money for the shop owner before he’s made any out-of-pocket expenditure.

So why not just go to your bank? If you have a good relationship with your banker and they know your business, then this is a viable option, especially if your credit lines are deep. However, many banks lack the specialized knowledge that dedicated leasing companies have in the automotive aftermarket. When a shop owner presents financials to his/her leasing partner as opposed to a bank lender, the leasing company has a rich history that informs their decision to approve a shop because they’ve seen tens of thousands of shop owner financials. A bank probably has less familiarity.

While banks are good generalists in making loans, they rarely have the focused insight of the handful of leasing companies specializing in the automotive aftermarket. This is evident in the amount of paperwork and time it takes to approve the borrower’s credit. Many leasing companies have a one-page lease and can approve credit applications within one or two hours of receiving the paperwork. It’s what they do best.

You don’t have to be a financial genius to approach leasing. When choosing a leasing partner to help you grow, take a good look at their reputation in your industry (they may be great working with fast food chains, but know nothing about your industry). Make sure they have a plain English contract and they explain, in writing, what you can expect at the beginning and end of the agreement. It always is a good idea to know your options!

Matt Doty is director of corporate communications at GreatAmerica Leasing Corporation. GreatAmerica (www.greatamerica.com) has been building relationships with manufacturers and vendors in the automotive aftermarket since 1992. Matt can be reached at [email protected].

SIDEBAR

Section 179 Tax Write-Off

Many business owners are unaware that $1 out of leases can qualify for this tax break. Qualified purchases with a value between $0 and $500,000 could be written off on your 2010 tax return. The Small Business Jobs and Credit Act of 2010 (H.R. 5297) was signed into law on September 27, 2010, and changes Internal Revenue Code (IRC) Section 179. Now, under IRC Section 179, business taxpayers may generally elect to take an outright deduction of up to $500,000 (up from $250,000 in 2009) of the cost of equipment placed in service during a tax year. If the aggregate cost of qualifying equipment placed in service during the tax year is greater than $2 million (up from $800,000), then the deduction is reduced by $1 for each dollar by which the aggregate cost exceeds $2 million. Consult your accountant or tax advisor to fill you in on how to take advantage of this break.