As new car shortages and rising prices continue, many consumers are choosing to keep their current vehicles. And with fewer trade-ins, the used car market is also suffering from historically low inventory and higher prices.

For many consumers, keeping their current vehicle has led to making upgrades for comfort, convenience, safety, maintenance, styling and more. That trend has created a boom in the automotive aftermarket industry, which grew 4% to approximately $48 billion in 2021. According to SEMA Market Research, 80% of aftermarket companies reported positive results, with many seeing double-digit growth in 2021. And nearly three-quarters (74%) of industry companies expect sales growth to continue in 2022.

By December 2020, auto parts imports were up 39% from 2019 levels. Through the first nine months of 2021, total auto parts imports increased another 34%, showing how much demand jumped during the pandemic. Domestic production of auto parts followed a similar pattern. Production in April 2020 was down nearly 28% from pre-pandemic levels. Currently, it is 14.6% higher than pre-pandemic levels. As of November 2021, three of the past four months have set new records for high-production output. Right now, parts production is higher than at any point in U.S. history.

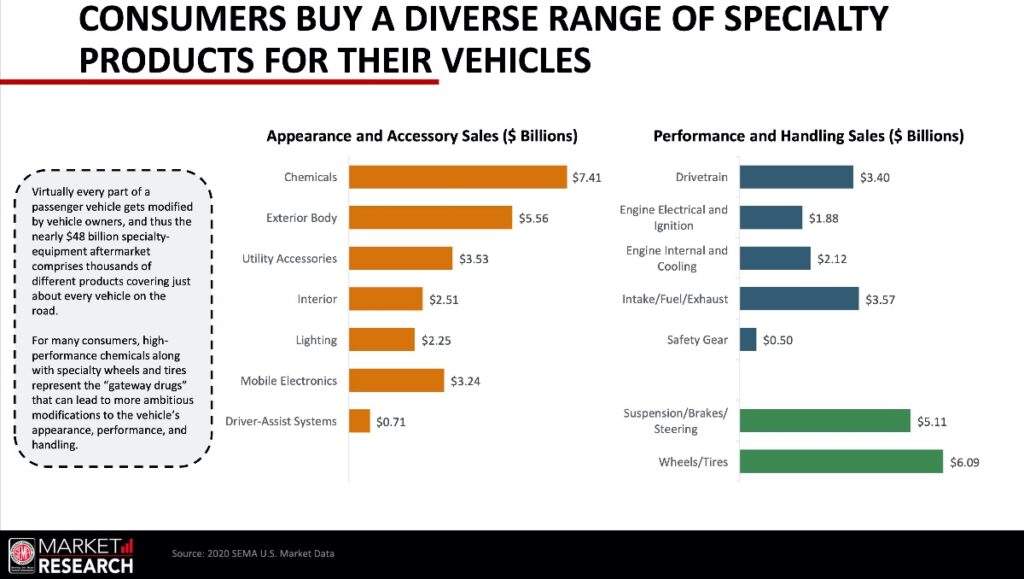

The automotive aftermarket reaches far beyond “bolt-on, go-fast parts,” SEMA says, and consumers are buying a diverse range of specialty products for their vehicles. Approximately 40% of specialty-equipment consumers modify their vehicles within three months of acquiring them; that number jumps to 50% within six months. The below illustrates product sales in billions by product category.

Chemicals continue to lead the way, with wheels and tires, and exterior body rounding out the top three categories.

Looking ahead for the aftermarket industry, SEMA Market Research reports that online retail sales are likely to fall as a share of total retail in 2021-22 as in-person options rebound. Projections also show that 80% of new vehicles sold through 2028 will likely be light trucks, with hybrid and EVs gaining some ground. These trends will help shape the types of products and accessories available to consumers looking to update and upgrade their vehicles in the future.

The complete “SEMA Future Trends – January 2022,” “SEMA 2021 Retail Trends,” and “SEMA 2021 Emerging Trends” reports are available to download for free at www.sema.org/research.