Running your own auto repair shop is an exciting journey. You get to wear different hats every day, take control of your own time and you no longer depend on a salary or W2.

But, at some point, as your business grows, you will need new resources to meet your customers’ growing demands.

So how do you know if your shop could use more funds? Check out the five signs below.

1. You’re experiencing cash-flow problems

Need to buy new inventory or supplies, but in doing so you won’t be able to cover payroll? A small business loan may help bridge the gap.

Maintaining positive cash flow throughout the year is easier said than done. Eighty-two percent of small companies go out of business due to poor cash flow management, according to a U.S. Bank study published on businessinsider.com. Applying for a small business loan may be the support you need.

If you’re having difficulty making ends meet and you see patterns of late bill payments, getting small business financing could help you cover expenses, or any outstanding debts. Plus, this leverages you with enough financial cushion for emergency situations.

2. Your team is experiencing burnout

Burnout is one of the most talked about employee concerns nowadays. Auto shops across the U.S. are experiencing staffing shortages. Shortages can take a toll on employees as well as owners.

An influx of working capital is a great way to purchase new tools to improve efficiency.

When you have sufficient cash in your account, it’s easier to make growth decisions, such as expanding your workforce. You don’t necessarily have to hire a full-time mechanic to do specific tasks; you can opt to hire someone on an on-call basis, just so you have the manpower to cover any surge in service demands.

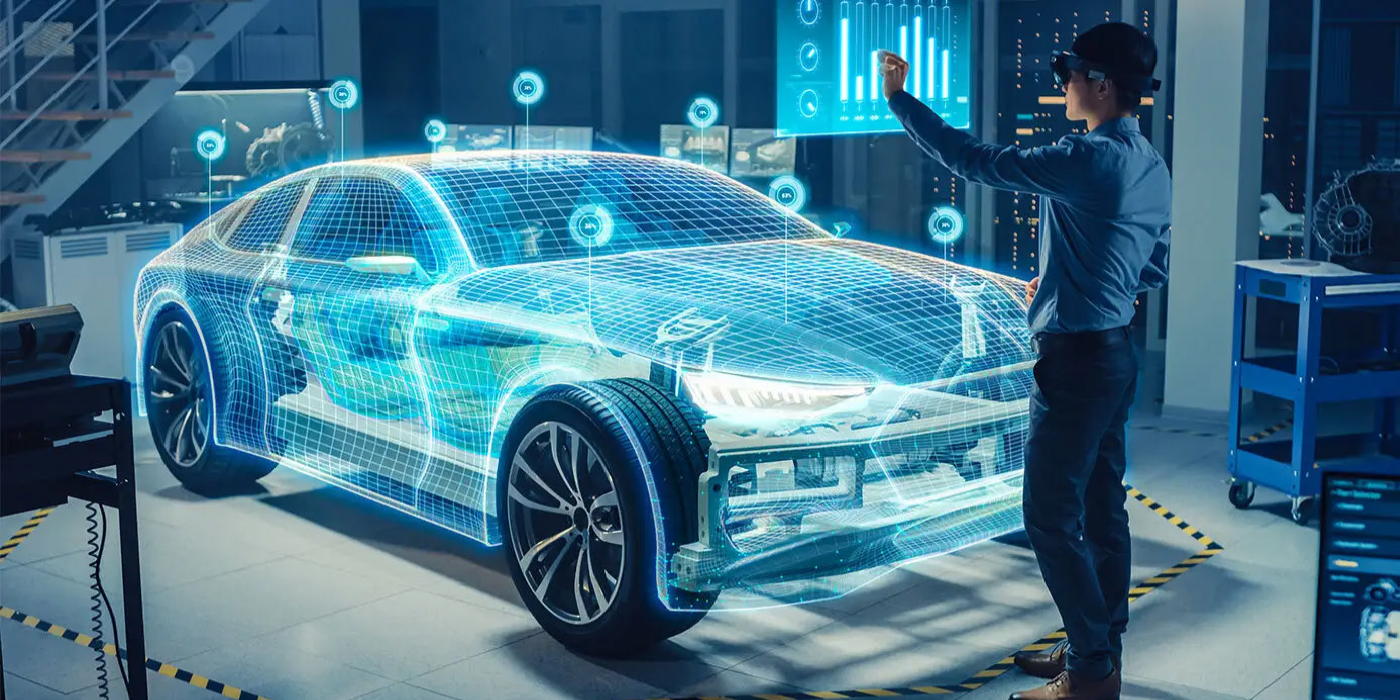

3. You have been rejecting customers

When customers are satisfied with your products and services, word spreads like wildfire. You’ll receive customer inquiries and service requests not just from your community, but from other cities as well.

Getting a surge in customer calls is usually a sign of growth. However, if your auto shop is not big enough to accommodate more cars or if you don’t have the right equipment to fulfill customer requests, you might get bad reviews.

Having more funds to cover these expenses will go a long way in catering to an influx of customers. You may use the funds to purchase new equipment, expand your shop, or set up a new branch to accommodate more customers.

4. Your bills are piling up

Being deep in debt can cause you a lot of stress. It also limits you from making growth decisions for your company such as engaging in partnerships or running social media ads. It gets difficult to plan for future expansion or save for emergencies, too.

If you think most of your profit goes to only paying off debts, getting small business financing can help you. Paying off large chunks of your debt through financing saves you a significant amount of money on interest payments. Plus, you avoid running the risk of delayed payments for rent or utilities.

5. You don’t have any money left for emergencies

When you’re stretched too thin, there’s not enough room for emergency situations. What would you do if your machinery suddenly stops working? What if a disaster strikes and your area is affected?

At the start of the COVID-19 pandemic, many small businesses were forced to shut down, mainly because they didn’t have the financial capacity to support themselves. Fortune reported that nearly 100,000 establishments that temporarily shut their doors have now permanently closed.

If another lockdown was implemented today, would you be able to support your business? Do you have enough resources to support your employees if it happens?

Business financing such as a line of credit will help you prepare for these situations. You can easily pull out funds from your account anytime you need them, and you will only be charged with interest for the amount you’ve withdrawn.

Taking out a loan will help you hit the ground running

Running and growing a small business can be challenging especially when you don’t have the capital to sustain it. From expanding the team to maintaining positive cash flow, you could use funding in a varietyu of different ways to make sure you meet customer demands and stay in business long-term.

Of course, any financial moves should be tackled after first consulting with your bookkeeper, accountant, or other banking or financial professional. Be sure your money moves help you long term and don’t just serve as a temporary fix for a bigger problem.